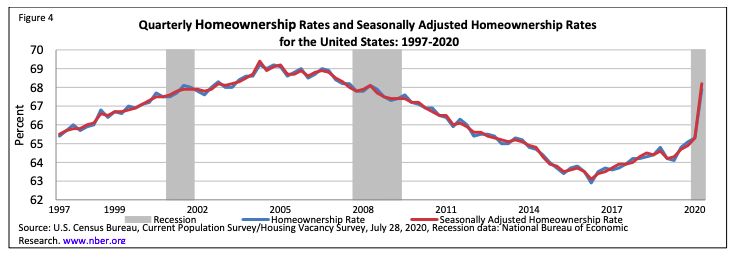

The U.S. homeownership rate moved significantly higher in the second quarter of 2020, reaching the highest level since the third quarter of 2008 at a rate of 67.9 percent. The U.S. Census Bureau reported the rate in the first quarter of the year was 65.3 percent and it was 64.1 percent a year earlier.

Homeownership topped 69 percent for most of 2004 and into early 2005 before beginning a steadily decline to a low of 62.9 percent in the second quarter of 2016. The year-over-year increase in the second quarter of 2020, 3.8 percentage points, represents 76 percent of the aggregate gain in the rate since that all-time low.

The increase was strongest in the South, up from 67.6 the previous quarter to 71.1 percent and a 5.1 percent annual gain. The rate rose 2.1-point year-over-year in the Northeast to 63.3 percent, and from 68.0 to 71.4 in the Midwest. The West increased from 59.3 percent to 62.6 percent over the 12-month period.

Homeownership among the oldest Americans, those over age 65, topped 80 percent for the first time in at least five years, gaining more than 2 points from a year earlier to 80.4 percent. Those under age 35 had a 40.6 percent rate, up from 36.4 percent. Among the 35 to 44-year-old cohort the rate moved from 59.4 percent in the second quarter of 2019 to 64.3 percent and the next older group went from 70.1 to 72.2 percent. The 55 to 64-year-old group's rate increased from 74.8 to 77.4 percent.

There was a significant increase in the Black homeownership rate which jumped from 40.6 percent to 47.0 percent, slightly closing the gap with white homeowners where the rate increased from 73.1 to 76.0 percent. Homeownership among Hispanics also rose, just under 5 points to 51.4 percent. The rate for all other ethnicities increased 4.2 points to 59.3 percent.

The wealth gap also tightened. Households with incomes less than the median had a 50.0 percent homeownership rate in the second quarter of 2019; it was 55.2 a year later. Those with incomes above the median increased from a 78.2 to an 80.5 percent rate.

Vacancy rates dropped during the second quarter compared to a year earlier. The rental rate dipped 1.1 point to 5.7 percent and the homeowners' vacancy rate fell from 1.3 percent to 0.9 percent. Both rates were also lower than in the first quarter of this year.

The total number of housing units in the country grew by 1.17 million year-over-year to 140.66 million units. Occupied units totaled 126.78 million, a 4.33 increase, however those occupied by an owner increased by 7.52 million while rental units were down 3.28 million.

The median asking rent for vacant rental units in the second quarter was $1,033. The median asking price for vacant for sale units was $205,600.