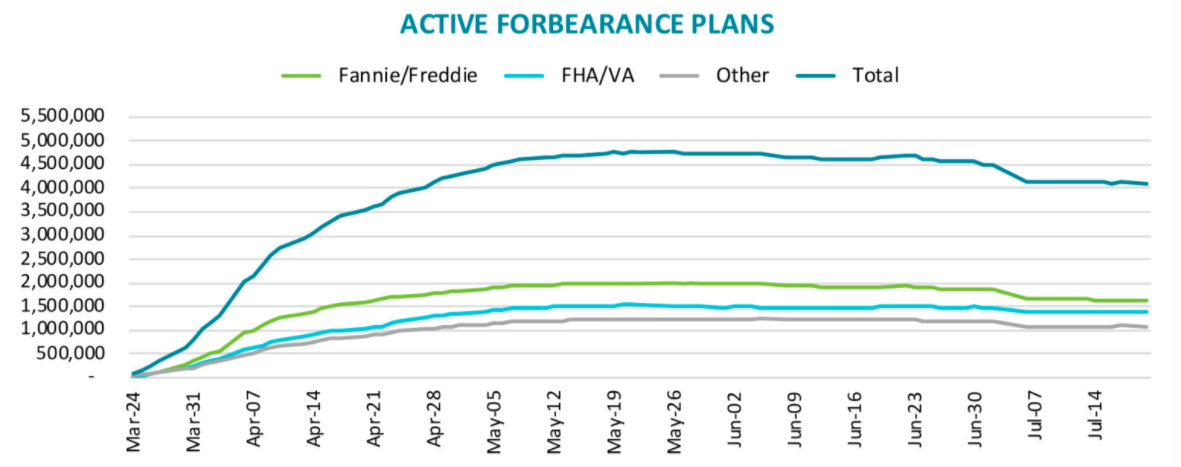

As of Wednesday, there were 4.102 million mortgages in forbearance plans. This is 7.7 percent of the 53 million loans in servicer portfolios. Black Knight said its weekly survey noted a 17,000-loan decrease in total forborne loans over the previous week. What remains represents $879 million in unpaid principal.

The number of GSE loans (Fannie Mae and Freddie Mac) loans in forbearance fell by 30,000 to 1.595 million, 5.7 percent of its total portfolio and an unpaid balance of $335 billion. Loans serviced for portfolio and private label securities (PLS) were also down, declining by 5,000 to 1.072 million or 8.2 percent of the total. However, loans serviced for Ginnie Mae, which guarantees FHA, VA, and USDA loans, rose by 18,000 loans to the highest level, 1.435 million, since early July. It was the third straight week of increases in that portfolio and brought the share of forbearances to 11.9 percent of the Ginnie Mae portfolio and a balance of $247 billion.

The GSEs have said that servicers would be required to advance principal and interest (P&I) payments to investors for only four months and many of the forborne loans have passed that mark, so Black Knight's estimates of those obligations may include amounts that are now assumed by the GSEs. Still they estimate the monthly P&I advances at $1.8 billion and advances for taxes and insurance (T&I) payments, which are not capped, at $0.78 billion. P&I payments on behalf of investors in Ginnie Mae loans are estimated at $1.3 billion and T&I payments at $0.6 billion. Services of portfolio and PLS loans have advance requirements of $1.8 and $0.6 billion, respectively.