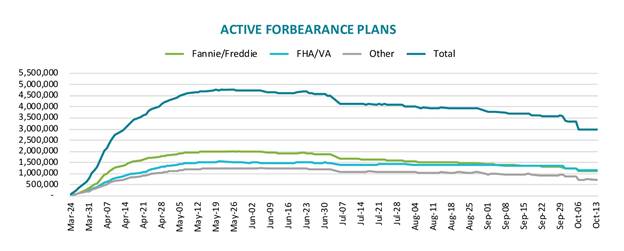

Last week Black Knight reported that the beginning of October saw a decline in the number of active forbearance plans of 649,000 or 18 percent as many plans reached the end of their initial period. It was the largest single week decline since the crisis began. This week the number of loans in forbearance edged up a bit. The company reported an increase of 19,000 plans, bringing the total to just under 3 million. Despite the increase, the share of mortgages in forbearance held steady at 5.6 percent. Forbearances peaked at 4.76 million plans in late May.

All investor classes saw slight upticks during the week. GSE forbearances rose by 3,000 to 1.11 million or 4.0 percent of the total portfolios and both FHA/VA and Portfolio and private label securities(PLS) forbearances increased by 8,000. This brought total FHA/VA loans in plans to 1.15 million, 9.5 percent of the total and portfolio/PLS forbearances to 731,000 or 5.6 percent. Seventy eight percent of forbearance plans have had their original terms extended.

Black Knight said, "All in we're still seeing good news: forbearance volumes are down by 708k from the same time last month, representing a 19 percent monthly decline."