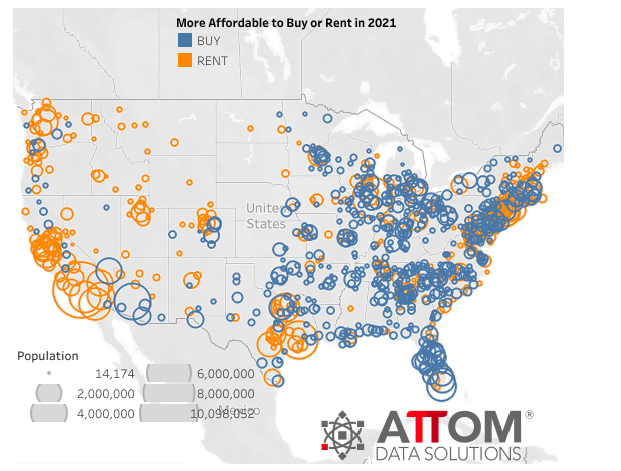

In most parts of the country owning a home is more affordable than renting one according to ATTOM Data Solutions' 2021 Rental Affordability Report. The company looked at the median price of a three-bedroom home in 915 U.S. counties and the rent for a comparable home and found owning more affordable 572 or 63 percent of them. The company says this has happened despite home prices increasing faster than rents in 83 percent of the counties and faster than wages in two-thirds. Renting, however, remains more affordable in the biggest cities.

"Home-prices are rising faster than rents and wages in a majority of the country. Yet, home ownership is still more affordable, as amazingly low mortgage rates that dropped below 3 percent are helping to keep the cost of rising home prices in check," said Todd Teta chief product officer with ATTOM Data Solutions. "It's startling to see that kind of trend. But it shows how both the cost of renting has been relatively high compared to the cost of ownership and how declining interest rates are having a notable impact on the housing market and home ownership. The coming year is totally uncertain, amid so many questions connected to the Coronavirus pandemic and the broader economy. But right now, owning a home still appears to be a financially-sound choice for those who can afford it."

Median prices for three-bedroom homes are increasing more than average three-bedroom rents in 764 of the 915 counties analyzed in this report including the counties surrounding Los Angeles, Chicago, Houston, Phoenix, and San Diego. All of those, save Phoenix, are among the 18 of the largest counties where is cheaper to rent than buy.

Among those large counties where rents are outpacing sales prices are those centered around Brooklyn and Manhattan as well as Queens and Bronx Counties in New York. Large markets where buying is more affordable than renting include Phoenix, Miami-Dade, Law Vegas, Fort Worth, and Fort Lauderdale.

Home ownership is more affordable than renting in counties with a population of less than 1 million, especially among those with less than 500,000 people. There are 94 counties with populations between a half and one million, and in 47 of them buying is more affordable. The same is true in 65 percent of the 779 counties with populations under 500,000.

ATTOM found that renting the typical three-bedroom property requires at least a third of average weekly wages in 506 of the 915 counties analyzed for the report (55 percent). The most affordable markets for renting are mostly in the South and Midwest and the least affordable rents were mostly in the West. Owning a median-priced home requires at least a third of weekly income in 442 counties. The most affordable home ownership markets also in South and Midwest; least affordable in West and Northeast.

The most affordable counties for owning among those with a population of at least 1 million are Detroit which required 15.2 percent of average wages to own, Philadelphia at 20.7 percent, Cleveland (20.9 percent), Pittsburgh (21.8 percent) and Charlotte (28.3 percent). There are also smaller markets with even lower income requirements, including the Knoxville area at 9.8 percent, Rocky Mount, North Carolina; Columbus, Indiana; and the Florence South Carolina area, all under 12 percent. The least affordable ownership areas are the usual suspects, large cities in Northern California, Brooklyn, Manhattan, and Vail Colorado.

ATTOM says that wages are increasing more than average fair market rents in 739 of the 915 counties analyzed in the report (81 percent), while rents are outpacing wages in 176. Home prices are rising faster than wages in 566 counties and wages are beating home prices in 915.