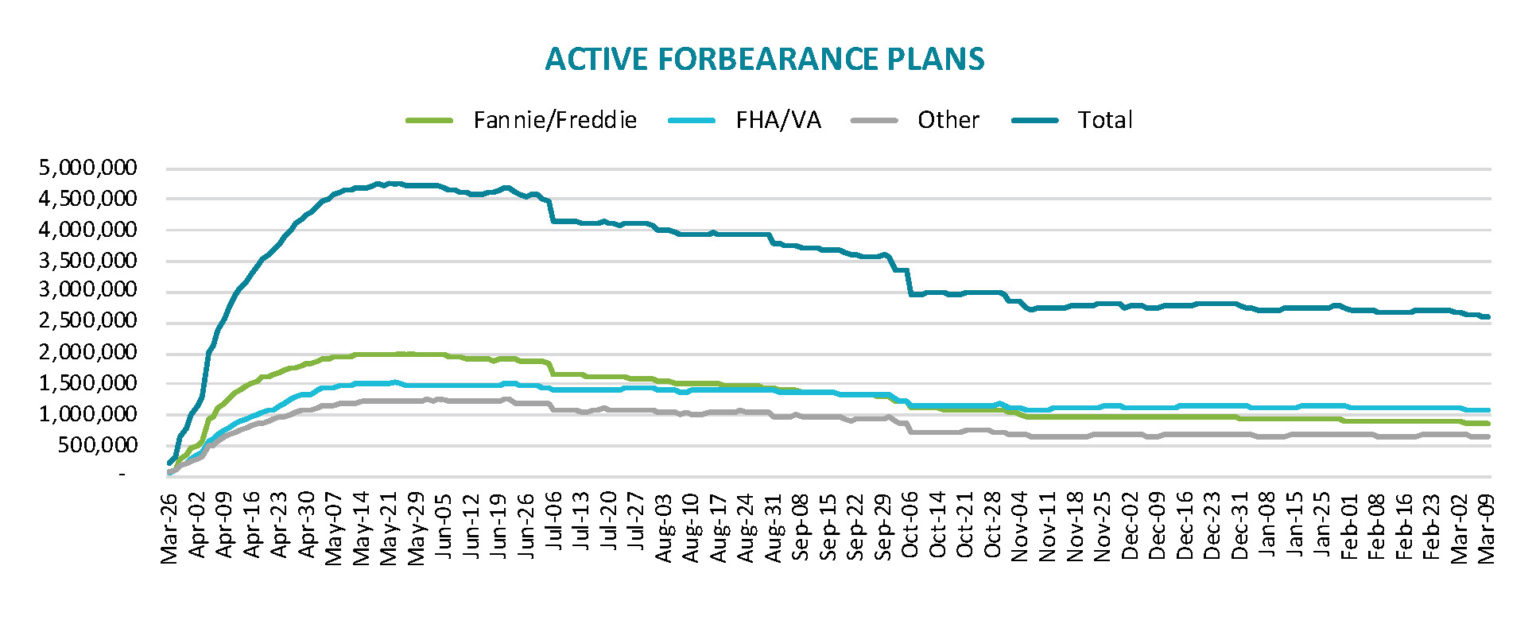

Black Knight notes a large improvement in forbearance statistics during the week ended March 9. The number of loans in active plans dropped by 77,000 over the week, the largest single week decline since early January, and lowered the number of plans to 2.6 million, a -2.9 percent change. At the end of the reporting period the remaining loans represent 4.9 percent of the nation's 53 million mortgages and an outstanding principal balance of $515 billion. It was the first time since April 2020 that fewer than 5 percent of U.S. mortgages were in forbearance.

Black Knight said the week's improvement was due to both the expected end of February expirations as well as servicers getting ahead of the curve in processing extensions and removals for the massive number of borrowers with expiration dates at the end of March. Although more than 100,000 of those loans have already been extended or removed, over 800,000 plans with end-of-March expirations must still be processed.

The company calls this "a daunting task for servicers". They must review upcoming expirations, taking action based on recent Housing and Urban Development and Federal Housing Finance Agency expansion of maximum forbearance terms to 18 months. Servicers are expected to continue to use three months for the term of extensions.

As of March 9, there were 871,000 Fannie Mae and Freddie Mac loans in forbearance, 3.1 percent of those portfolios. Forborne FHA and VA loans total 1.78 million and 659,000 are loans serviced for bank portfolios or private label security (PLS) investors. Those loans represent 8.9 percent and 5.1 percent of their respective portfolios.