The Urban Institute (UI) says it appears that the current sellers' market is having a negative impact on government backed loans and the borrowers who need to use them. In an article posted on UI's Urban Wire blog, Janneke Ratcliffe and Laurie Goodman write that, while soaring home prices and historically low inventories of available homes have been good for sellers, many of them are unwilling to accept offers backed by FHA or VA financing.

In a recent survey of agents conducted by the National Association of Realtors (NAR) found 89 percent of sellers would be likely to accept an offer from a buyer with conventional financing, but only 30 percent if the buyer were using a government-backed loan. Six percent would not even consider such an offer.

UI says that data collected through the Home Mortgage Disclosure Act (HMDA) data shows that such flat-out rejection of VA and FHA financing disadvantages households with lower incomes, lower credit scores, and less wealth, many of whom are persons of color. This is likely to exacerbate the existing racial homeownership gap.

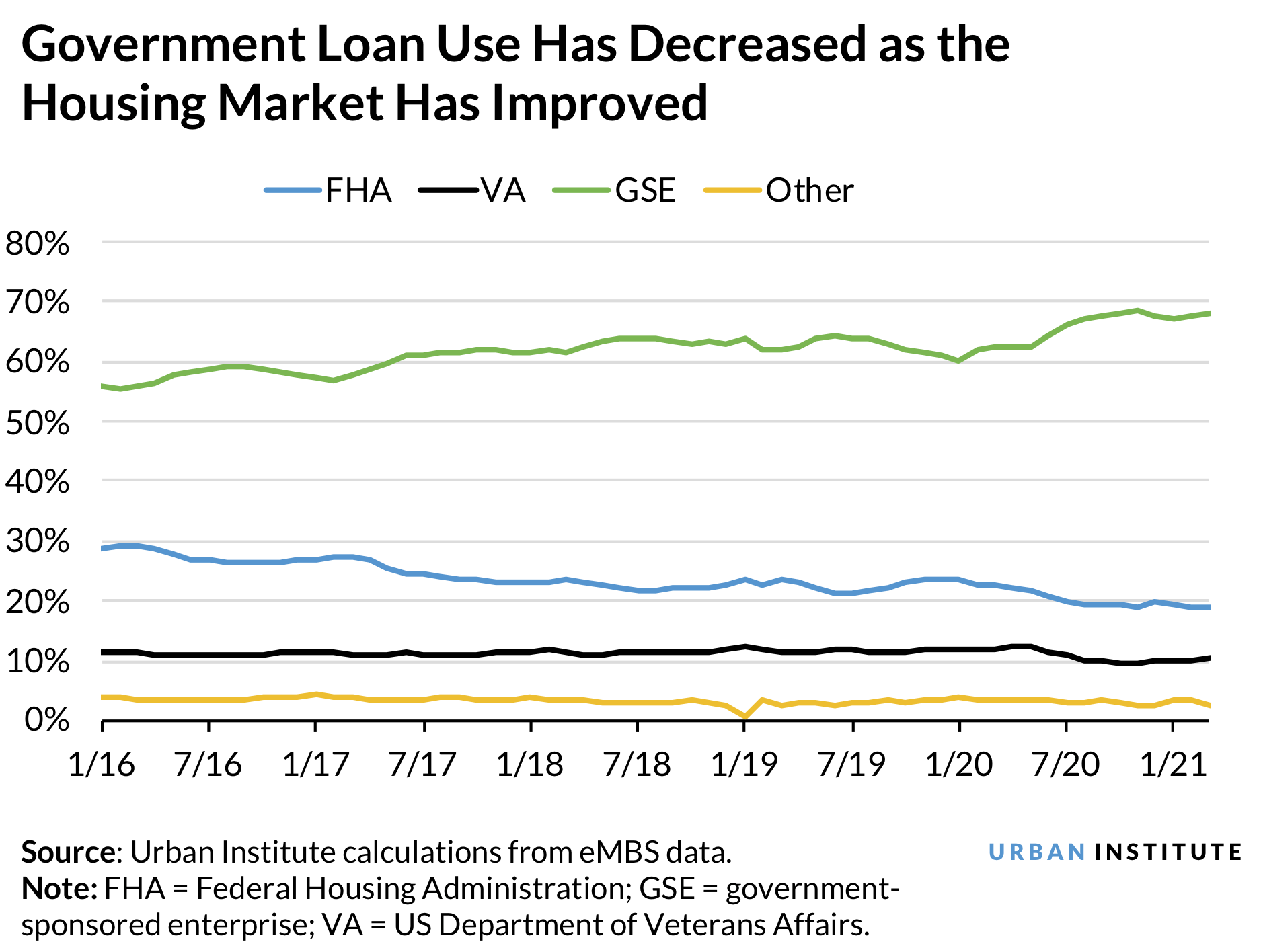

The UI analysts calculated the share of government and government-sponsored enterprise (GSE) purchase loan originations over the past 4.5 years. They did not include bank portfolio loans and private-label securities due to a lack of complete data for them.

Between mid-2017 and May 2020, the FHA share of purchase originations ranged from 21.5 to 24.0 percent of the agency market, an average of 22.8 percent. The number, however, has dropped to 18.9 percent in April and May. The VA share averaged a steady 11.5 percent over that early period but dropped to 10.3 percent in those two months. Though a piece of the decline might be due to home values rising above FHA loan limits, those limits increased in January 2021, while the FHA and VA shares continued to drop.

The latest available HMDA purchase data (2019) shows a much higher share of FHA and VA borrowers were Black or Hispanic compared to conventional borrowers, in some cases more than a 10 point difference. Also, 41.9 percent of FHA borrowers and 36.3 percent of VA borrowers were younger than 35, compared with 33.6 percent of conventional mortgage borrowers.

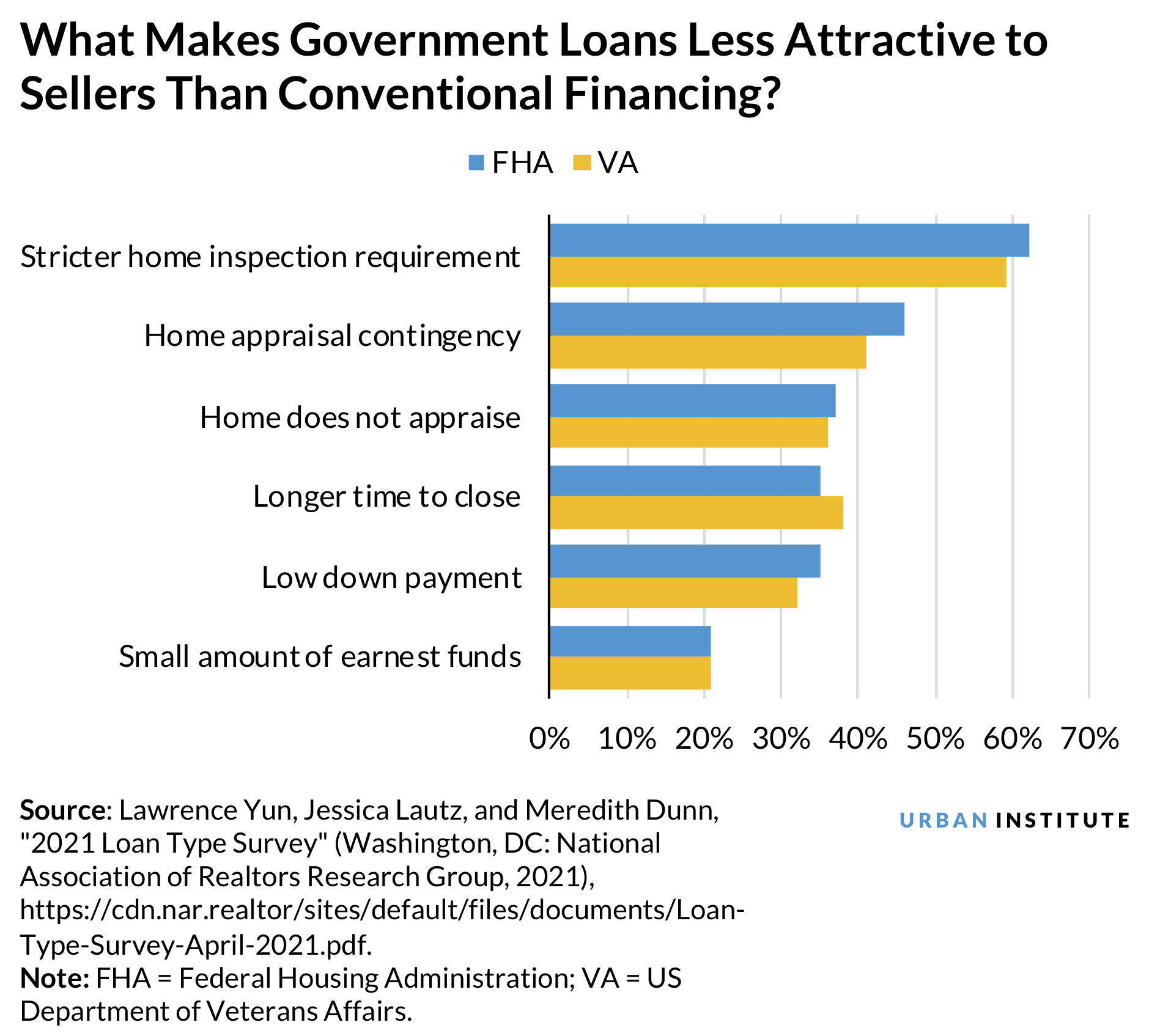

In its survey of loan types, NAR asked agents what makes FHA and VA loans "less attractive" to sellers than conventional loans. Home inspection requirements topped the list, followed by appraisal issues, longer time to close, and low down payments.

Government loans require property inspections to detect health, safety, and security risks such as lead paint, failing roofs, or appliances nearing the end of useful live. Inspections are not required for conventional loans, and in a tight market many buyers chose to forego them or use them only for informational purposes.

When a home is appraised for less than the agreed-upon price, FHA and VA require that the seller must reduce the purchase price to match the appraisal and if the deal falls apart, the appraisal stays with the home for 120 days. With conventional financing, the parties can renegotiate the price and the buyer can make up the difference if he/she chooses.

Government loans are slower to close, often because of needed repairs. According to Ellie May, it took an average 57 or 58 days to close FHA or VA purchase loans in the first three months of this year compared to 51 days for conventional loans.

Conventional loans typically require either a 20 percent down payment or private mortgage insurance, while government-backed loans allow lower down payments, a big reason they are used disproportionately by first-time, low-wealth, and younger borrowers. The authors question why a low down payment would be a concern for sellers, but they may view it as a proxy for certainty of closing.

Ratcliffe and Goodwin say there are several things the federal government could do to level the playing field and make first-time borrowers, borrowers of color, or with less wealth, more competitive in the housing market. First, the rules for FHA and VA could be more closely aligned with those of Fannie Mae and Freddie Mac. The Department of Housing and Urban Development (HUD) and the VA could consider either eliminating the home inspection or making it less prescriptive and they could consider more flexible appraisal requirements, again more akin to those for GSE mortgages.

The authors conclude that, "Reducing these barriers can help government borrowers gain more equal footing with conventional borrowers. It is just one of many steps that could shrink the racial homeownership gap and make the mortgage market fairer and more equitable for all borrowers."