It's no mystery that the housing and mortgage markets are facing their fair share of headwinds in 2023, but some blow harder than others. One of the most complicated headwinds is that of Federal Reserve.

At first glance, the Fed's decisions to hike or cut rates are extremely important. In addition to being prominent in the news, few other financial topics are as likely to make it into everyday conversation as the latest Fed rate change.

In all fairness, the Fed Funds Rate (the thing the Fed is actually hiking/cutting) is extremely important, but not in a perfectly obvious way. The biggest source of confusion stems from the fact that financial markets typically already know what the Fed is going to do on any one of the 8 scheduled rate-setting meetings per year. After all, there are only 8 meetings whereas the rates on something like US Treasuries might change 8 times before you're done reading the next sentence.

In this week's case, the market knew with as much certainty as it ever has that the Fed would hike the Fed Funds Rate by 0.25%. As such, the rate hike was already reflected in the rest of the interest rate landscape. This brings us to the second important point: there are many types of interest rates that apply to many different kinds of borrowing. The Fed Funds Rate merely serves as an anchor or a reference point for the shortest periods of time and the simplest of terms. The more time and complexity one adds to a loan, the less it may resemble the Fed Funds Rate.

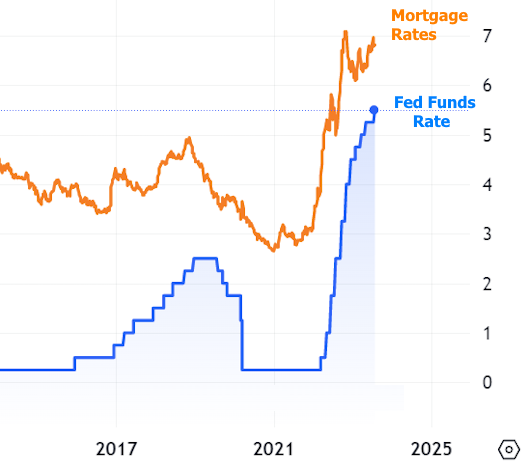

Mortgage rates are a good example. Like most rates, they tend to correlate with the Fed Funds Rate over very long time horizons. Zoom in a bit, and things get weird. There are many examples of mortgage rates falling while the Fed is hiking and vice versa.

The easiest way to understand this phenomenon would be to say that whatever matters to an interest rate, the Fed Funds Rate only has to worry about it for 24 hours whereas a mortgage rate might have to worry about it for 30 years.

Now here's the catch: mortgage rates may not care about the Fed rate hike on the day it happens, but they definitely care about Fed rate expectations. They also care deeply about the Fed's general policy stance as that can help the mortgage market get ahead of the next likely move in the same way it was 100% positioned for this week's move.

The general policy stance can receive quite a bit of clarity on the same day the Fed announces a rate hike/cut because those announcements are always followed by a press conference with the Fed Chair. This time around we were curious to see if Powell's stance would be softened at all by recent progress on inflation. While he did acknowledge that progress, he said just as much to remind the market that the Fed's fight against inflation isn't over.

In other words, Powell threaded the needle and rates barely budged in response. It wasn't until the next morning that the situation began to deteriorate due to stronger economic data.

Econ data is always a consideration for rates, regardless of Fed policy. And at present, it also happens to be very important to the Fed as well because the Fed is looking for a bit of an economic slowdown for evidence that its inflation-fighting policies need to be reconsidered. This is precisely why the Fed went through with another rate hike this week despite recent inflation data suggesting that hike wasn't necessarily warranted.

But as long as jobless claims are hitting the lowest levels since February and GDP is hitting 2.4% versus expectations of 1.8% (both happened on Thursday morning), the Fed can afford to err on the side of "higher for longer" when it comes to the Fed Funds Rate.

Mortgage rates will ultimately end up falling well before the Fed embarks on its next rate cut cycle. Cues for that shift will come from--you guessed it--economic data. But it will take months of data with a consistently downbeat message to do the trick. Basically, the economy has to clearly be losing for rates to clearly be winning.

Until that happens, it will remain challenging for the housing market to muster enough inventory and buying demand to get sales back to pre-covid levels. The only exception is the New Homes market, which has done much more than its fair share of heavy lifting recently. The latest report came out this week and although it fell a bit short of expectations, the broader trend remains intact with sales very close to pre-covid highs.

Pending Home Sales data was also out this week and the takeaway is different there. The index managed to increase modestly, but remains near post-covid lows.

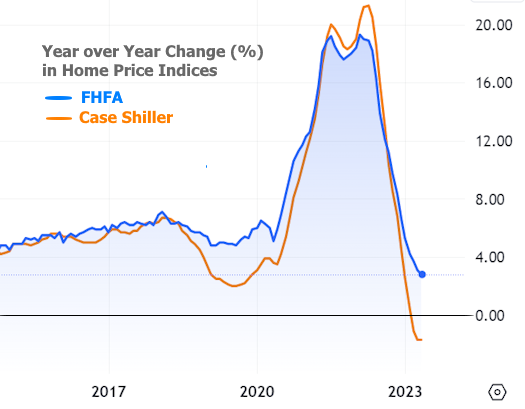

One upside of tight housing inventory is that prices have been downright resilient relative to last year's forecasts. The more volatile Case Shiller index is in negative territory year-over-year, but FHFA's broader index is still up 2.8%.

And when we change the chart to track month-over-month price changes we can see that prices have already bounced:

If econ data is the biggest game in town, the upcoming week is huge. There are several highly consequential reports coming out almost every day. The headliner will be Friday's monthly jobs report from the Labor Department--the one economic report that every rate watcher would choose to watch if they could only watch one.