There were multiple economic reports on tap this morning (4 of them in the 8:30am slot), but the headliner on a Retail Sales day is almost always going to be Retail Sales! In today's case, it came out much stronger than expected. Even when stripping out autos/gas/building materials (i.e. the "control group"), sales rose 0.5% vs a 0.3% forecast. This is the sort of thing that would normally put pressure on bonds, but that's not the case today. Why? Revisions are one consideration. Last month was revised down by the same amount that today's number beat the forecast. Inflation is another consideration. After adjusting for it, the control group continues to trend lower, not higher. In other words, sales may be increasing in terms of dollars, but people are buying less "stuff."

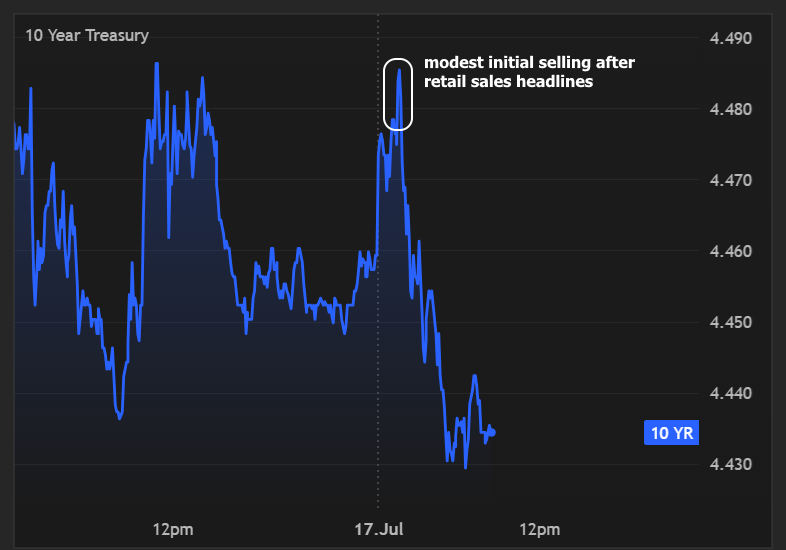

Bonds reacted by trading the headline at first (higher yields), but only briefly. Traders were all over the "lower inflation-adjusted spending" narrative and quickly traded 10yr yields about 5bps lower from the highs.