Given that a bilateral trade deal between the U.S. and EU was announced over the weekend, markets haven't moved much at all in response. 10yr yields were briefly lower overnight and are now inconsequentially higher in early domestic trading. Perhaps the uncertainty surrounding U.S./China negotiations is keeping traders cautious. On a less speculative note, while Monday doesn't offer any big ticket econ data, there are two big Treasury auctions (2yr and 5yr). Not only is this a day earlier than normal, but it's also a double whammy. Treasury notes/bonds usually get their day, but this week's schedule is accelerated due to month-end falling on a Thursday. In addition to month-end (a trading motivation in its own right) and Treasury auctions, there is a slew of relevant econ data starting tomorrow as well as a Fed announcement on Wednesday.

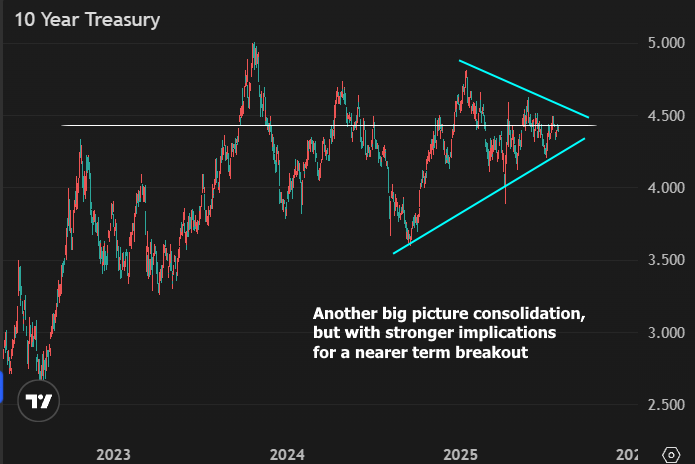

Without any meaningful market movement to discuss so far this week, let's take a look at the big (and bigger) picture. With the exception of summer 2024 and the subsequent rebound, not much has happened for rates since hitting the ceiling in late 2023. Since then, once could easily argue there's been general consolidation around 10yr yields just under 4.5%.

Another manifestation of that same consolidation has been especially convergent on the midpoint since the late 2024 lows, with only one brief breakout on tariff announcement week.

What does this all mean? The market can't see a compelling reason to trade 10yr yields up to 5%+, nor can it make any immediate case to break below 4.0% (and 4.5% is in the middle). Much remains to be learned regarding the final impact of yet-to-be-finalized trade policies as well as the state of Treasury issuance--perhaps the more critical wild card when it comes to the bond market's ability to rally like it used to.