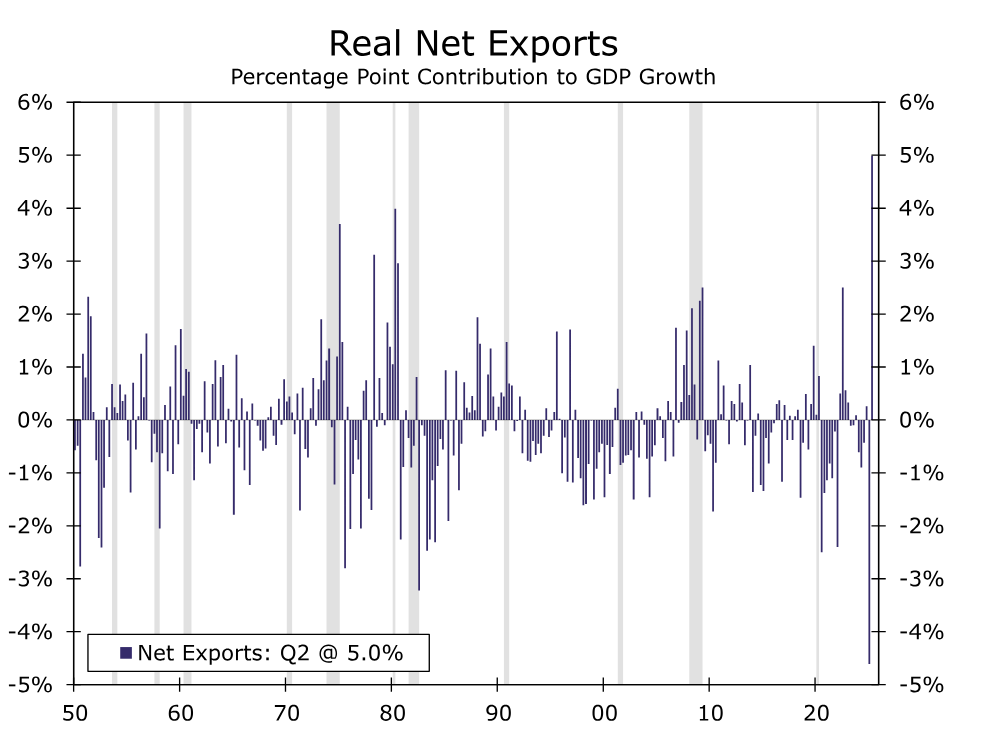

There were two key reports at the start of trading today. The 815am ADP data was fairly forgettable, coming in at 104k vs 75k f'cast, and -23k previously. This is well within a range of outcomes that are arguably inconsequential for bonds. Subsequent trading reflected that fact. 15 minutes later, GDP came out at 3.0 vs 2.4 f'cast, and -0.5 previously. Bonds are basically trading that GDP beat, even though we disagree that they should be. Reason being: true domestic demand metrics continued to fall. Q2 was inordinately helped by the same net export component that tanked Q1 numbers.

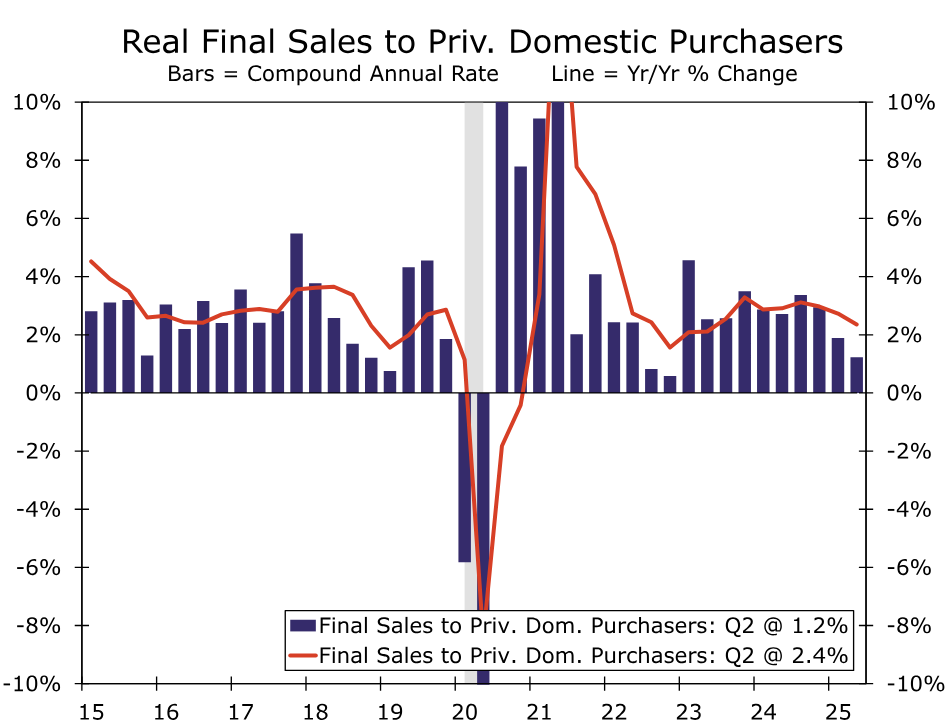

Contrast that to inflation adjusted sales to domestic purchasers, which continues a trend of contraction.

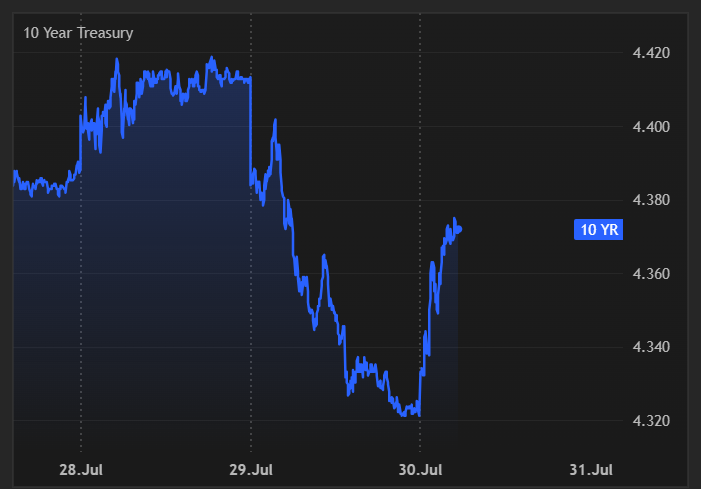

Since the bond market weakness doesn't really make sense in this light, we can also consider that core PCE prices were 0.2 higher than expected which means tomorrow's monthly PCE data runs a higher risk of coming in hotter. Either way, bonds have only erased about half of yesterday's gains so far. The Fed announcement and press conference are more than capable of reversing this move or adding to the pain.