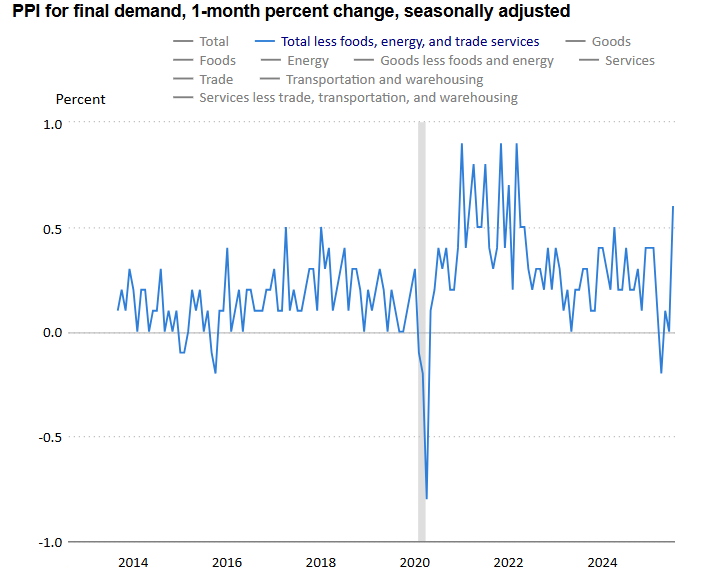

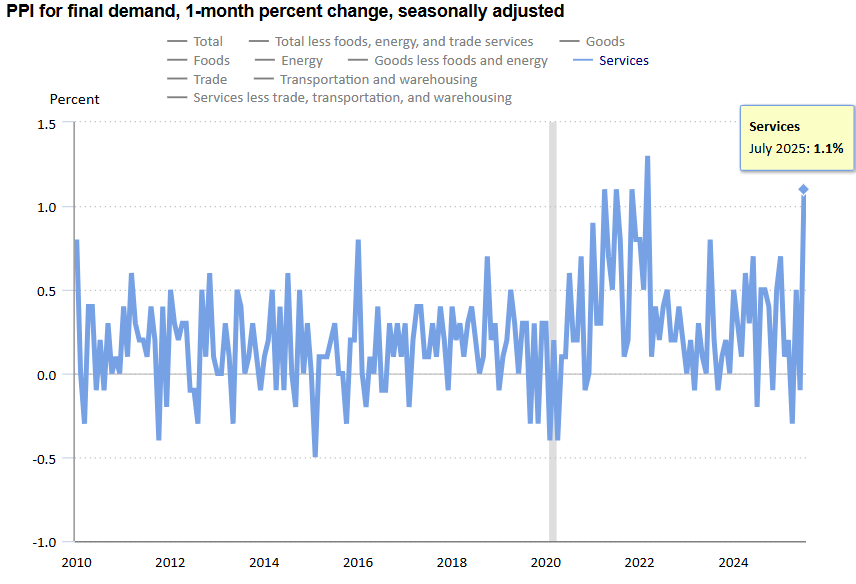

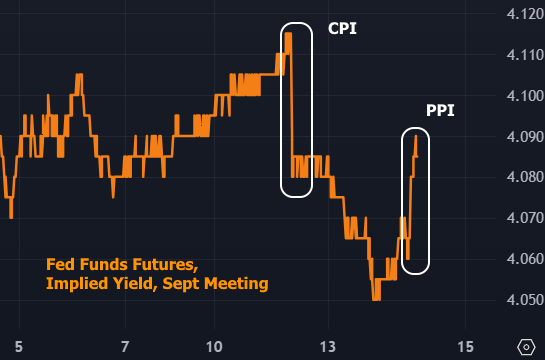

There's no question that today's Producer Price Index came in surprisingly hot. Both the headline and core numbers were 0.9% vs forecasts of 0.2%. The biggest impact came from "trade services" which speaks to wholesalers and retailers marking up margins. There were similar anecdotes in other categories with BLS specifically calling out machinery/equipment, portfolio management, and vegetables. This was enough to erase a moderate overnight rally and cause some weakness in bonds, but it's not nearly as big of a reaction as we'd be seeing if Tuesday's CPI reported a similar beat. PPI is a much more volatile data series and the components that flow through to PCE inflation suggest a smaller spike in consumer inflation. Nonetheless, upward movement in consumer inflation is eroding some of the recent improvement in Fed rate cut expectations.