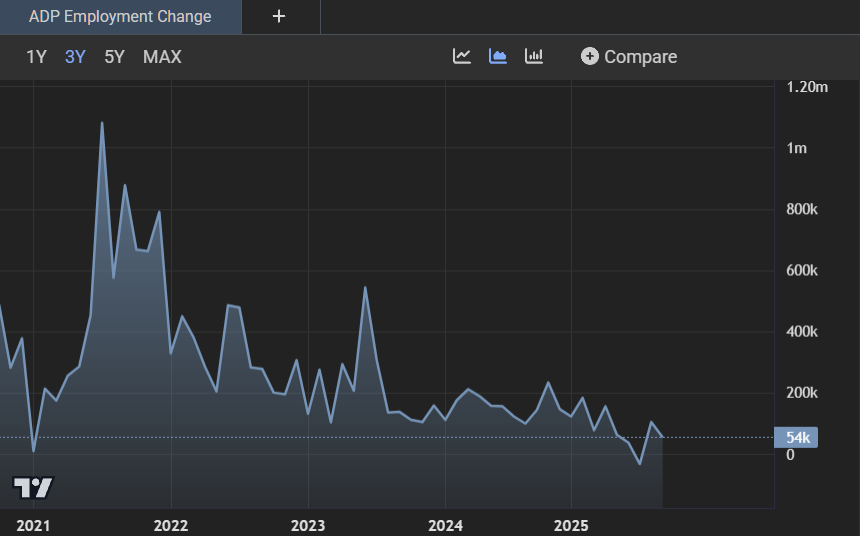

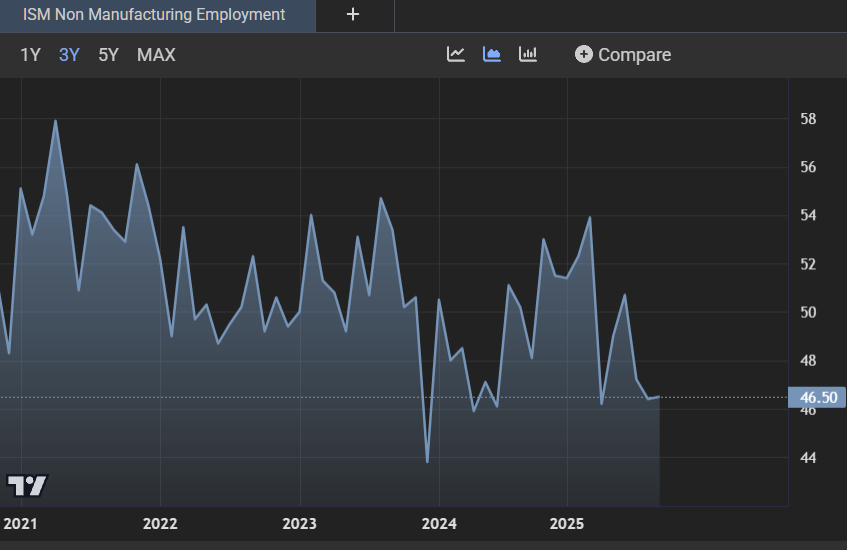

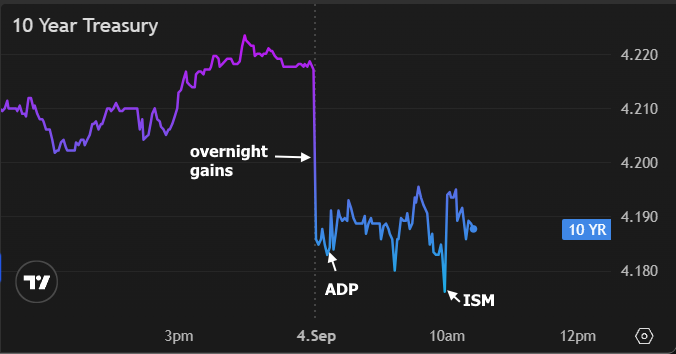

Thursday morning's slate of econ data was the most active of the week with claims, layoffs, ADP, and ISM Services (also the Trade Gap and Labor Costs, but those aren't really in the "market mover" category). Ironically, almost all of today's movement happened in the overnight session whereas the mixed data has seen a broadly sideways reaction. ADP was slightly weaker than expected, but it wasn't enough for bond buyers (there was modest selling after ADP). ISM was a bit stronger at the headline level, but the bond-bearish message was tempered by weak employment and a modest downtick in prices. Bottom line: this data isn't weak enough to prompt a friendly lead-off ahead of Friday's jobs report, but not strong enough to derail the overnight gains.