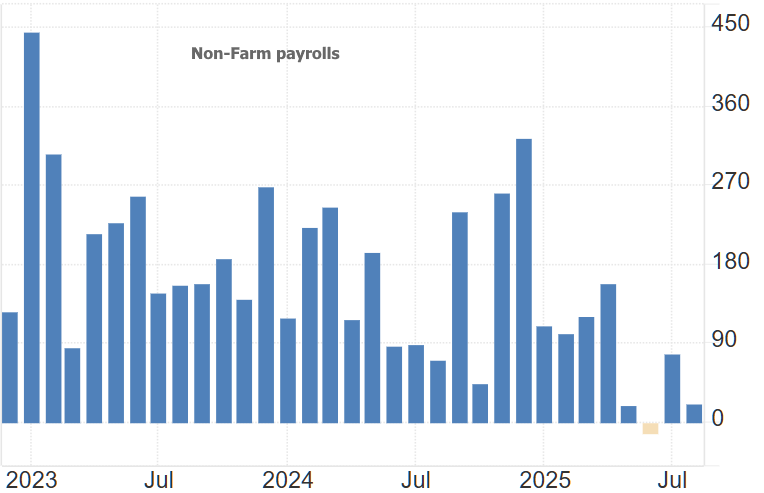

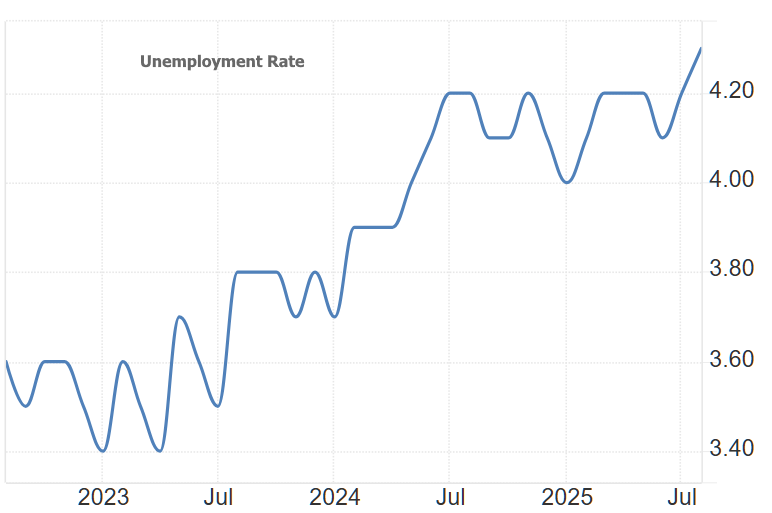

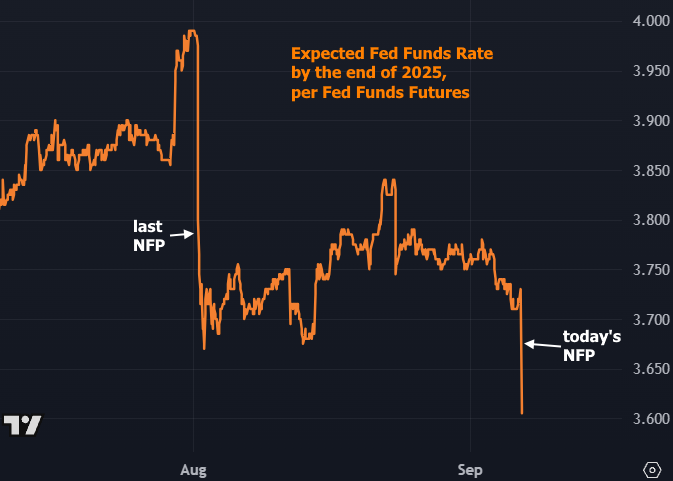

It's a fairly straightforward morning with NFP coming in much weaker than expected with additional net-negative revisions to the previous 2 months. The only real caveat is that the unemployment rate suggests a more gentle softening of labor market conditions--a fact that likely accounts for 10yr yields "only" being 6-7bps lower in the first half hour of post-NFP trading. The other way to account for it is to say that bonds had already rallied from 4.3 to 4.16 in the 3 days leading up to this morning. That overall move is about the same size as the 8/1 post-NFP rally. Either way, bad news for labor market is good news for rates.