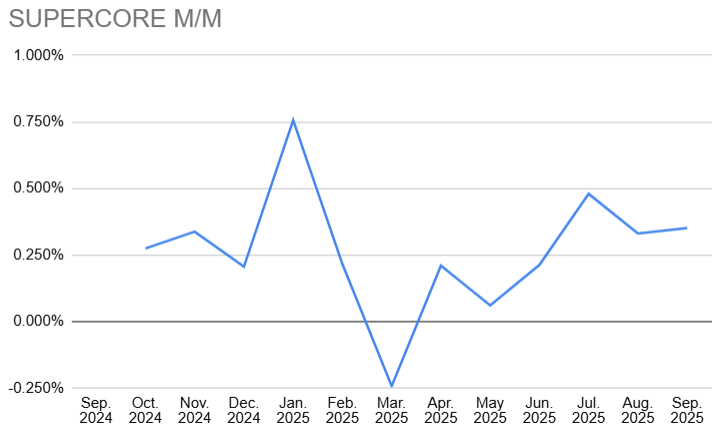

In terms of topline results, CPI was bond friendly with the core at .223 vs .3 and the headline at 0.3 vs 0.4 in monthly terms. Annually, we're running at 3.0% in both metrics, which is high, but also 0.1 lower than expected. That's the good news, and it's the reason that bonds are stronger after the data. The not-so-good news involves metrics that attempt to strip out tariff impacts and/or housing in order to determine the inflation momentum that is less elastic. Supercore is the most notable of these and it came in at .351 m/m vs .330 last month. While that's still better than the alarming .479 reading in the July data, it's too high for the Fed to take its eye off inflation when it comes to rate-cutting aggression. If there's a reason that 10yr yields rallied a quick 4bps only to erase half of those gains, this is probably it.