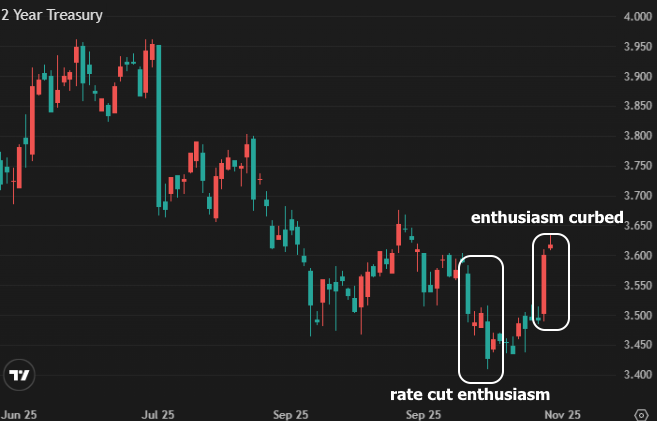

The simplest way to understand yesterday's post-Fed sell-off is as follows. The market's enthusiasm for 3 Fed rate cuts in 2025 had grown a bit too large for the Fed's liking. The market was nearly 100% certain of another cut in December. The Fed was not as certain, and Powell made it a point to say so yesterday. The result is a mild re-set in yields back to levels that are more consistent with a December cut being a solid possibility, but not a full lock. Now we wait to see if the non-gov econ data tips those scales in one direction or the other. This morning's additional selling is an acceptable and arguably inconsequential level of follow-through to the brunt of yesterday's "reset" vibes.

In terms of specific Fed rate expectations: