If there's one resounding theme in the bond market this week, it's that trading momentum marched to its own beat with almost zero regard for the available economic data. While this was a notable disconnect on Wednesday (little reaction to ADP/ISM), it's fairly easy to reconcile on a day like today where the PCE data is super stale (delayed release from September) and the only other report, Consumer Sentiment, rarely has an impact.

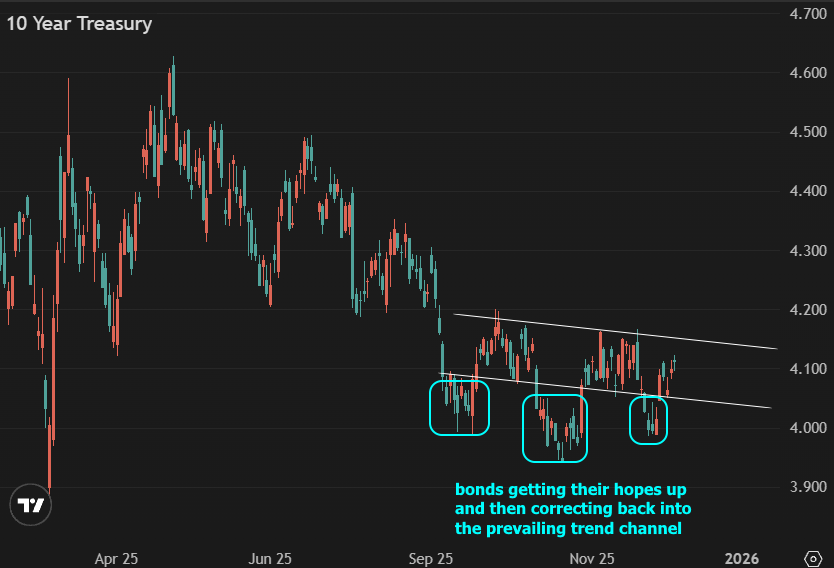

In general, the past 5 days have marked a casual return to the prevailing range (or more appropriately, the prevailing trend channel), thus setting the stage for a bigger break after the bigger events on the horizon (Fed day next week and jobs report the week after).