Bonds are adding moderate to yesterday's post-Fed gains. Most of today's rally has followed this morning's jobless claims data, but we wouldn't necessarily give it all the credit. This is a tricky week to try to make sense of jobless claims due to the very late Thanksgiving holiday this year. It threw a wrench in seasonal calculations. In a nutshell, last week's initial claims plummeted due to Thanksgiving and seasonal adjustments didn't help much because, on average, Thanksgiving falls on the 25th (thus, last week's claims were too late in the month to get much benefit from the adjustment). Continued claims magnify the same issue with this week's data (continued claims run 1 week behind initial claims). This is why we have the biggest jump in years in both metrics with one being higher and the other being lower. It's all about seasonal adjustments. If we do our best to look through that, non-adjusted continued claims are the highest in years, and bonds could be paying some attention to that.

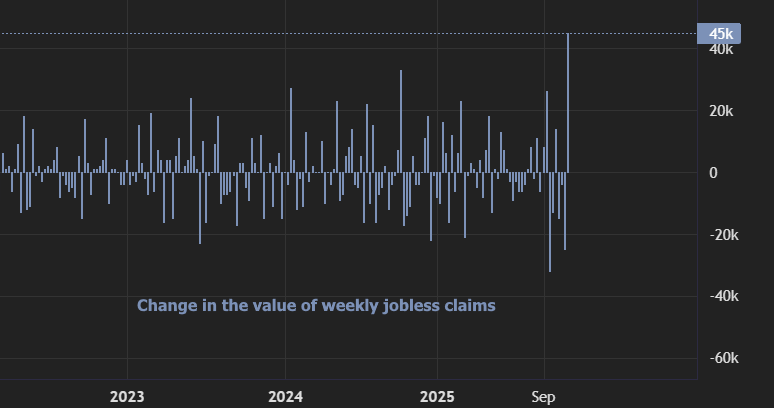

This seasonally adjusted chart shows the snap back to reality for initial claims. It would have been a smaller jump if last week wasn't distorted on the low side.

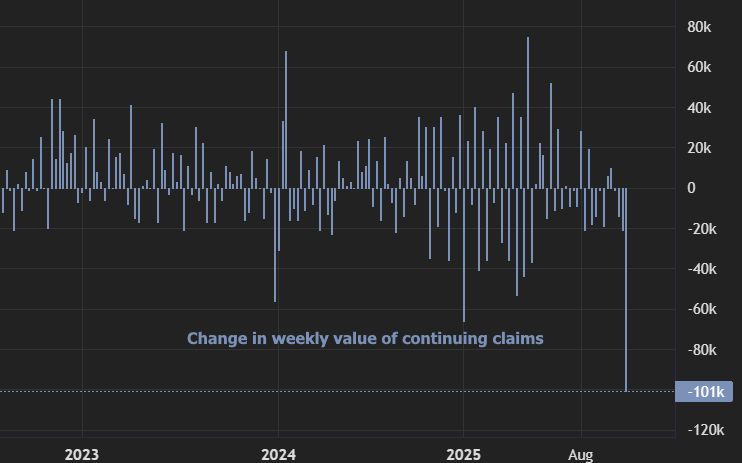

Opposite problem for continued claims, which are reported 1 week later (i.e. you can bank on a big snap back next week):

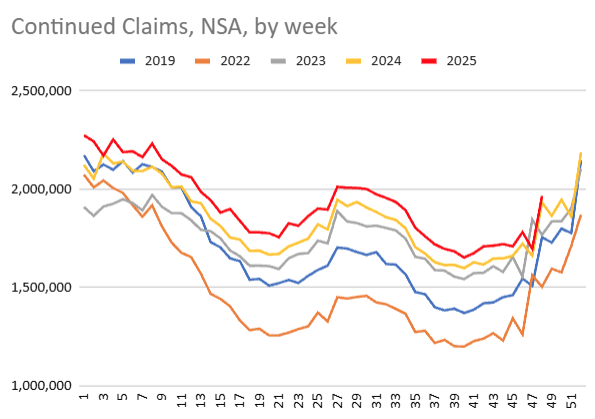

The following chart shows NON-seasonally adjusted continued claims. With this chart, it's easy to see 2025 running at the highest levels in years. Bonus point for those who see the gray line poking briefly higher only to realize Thanksgiving was on the 11/23 in 2023.