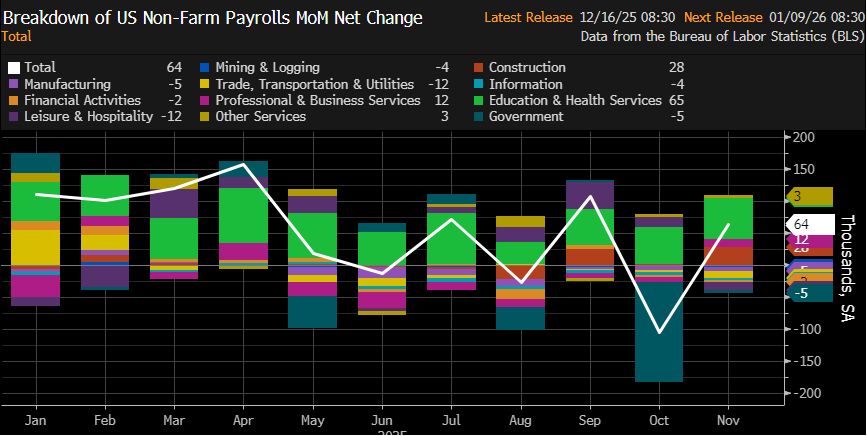

If there was one metric in this morning's data that should be helping the bond market, it's the uptick in the unemployment rate from 4.4% in September to 4.6% in November (a new cycle high). This is mitigated somewhat by the uptick in participation rate (0.1%) and the slightly higher payroll count (64k vs 50k f'cast). In addition, BLS noted lower response rates for the household survey (unemployment rate) and a generally unknown impact from the government shutdown. Perhaps important is the fact that the unrounded unemployment rate only rose 0.13% versus the 0.2% rounded figure. Bond market volume has been predictably stratospheric, but the movement has been frustratingly flat. All in all, the jobs data simply confirms exactly what the Fed has been saying: modest ongoing weakness in labor market, but nothing catastrophic. It leaves room to focus on Thursday's CPI as policy-setting counterpoint.