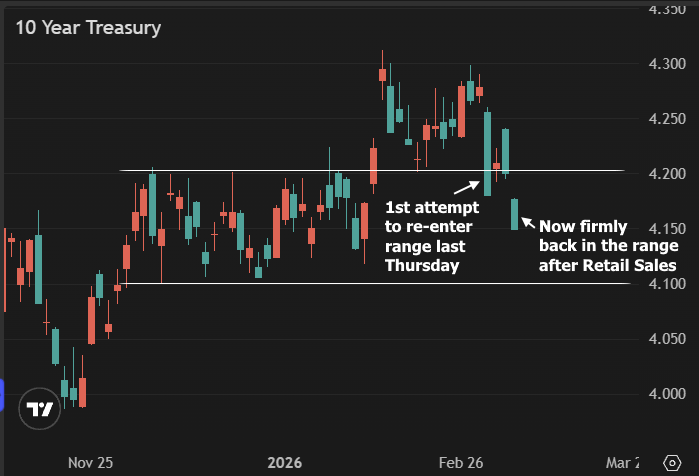

Last Thursday, we discussed the paradox of a rally in the present moment being driven by future data. More specifically, the three downbeat labor market reports increased the stakes for tomorrow's jobs report. Depending on trends and trading positions, risks can be asymmetrical. A trader who expected higher rates might have only seen a modest increase in yields if the data was stronger, and a bigger decrease in yields if the data was weaker. The market already rejected a break above 4.30% in the 10yr. Then multiple reports suggested additional buying and additional risk of a weak jobs report. The choice to move back toward a familiar recent range (4.1-4.2) became clear with this morning's weak retail sales data. Just be aware that if Wednesday's jobs report is stronger, yields could pop right back over 4.20.