Mortgage rates finished the week at their lowest levels since August 2022. In outright terms, this is far from the record lows, but rates set another kind of record.

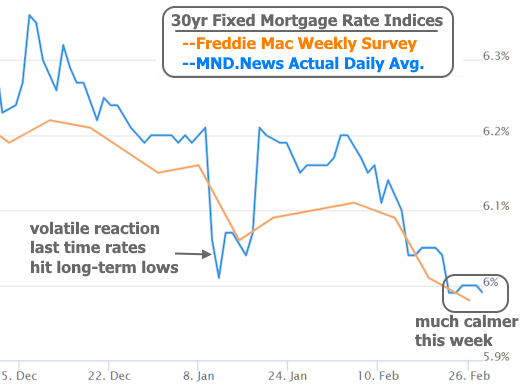

Volatility is a common negative side effect associated with rates hitting multi-year lows. For example, back on January 9th, the MND rate index briefly hit 5.99% before bouncing back to 6.06% later that same day, and 6.21% within 2 weeks.

Contrast that to the present week. The index hit 5.99% on Monday, and this time, it stuck--never moving above 6.00%. In other words, this week's range was 5.99-6.00%.

Since daily record-keeping began more than 15 years ago, this is the narrowest weekly range that's ever followed a move to a multi-year low.

It may seem like we're just making up records like they're new Academy Award categories no one has ever heard of, but this one matters. The typical volatility surrounding long-term lows means that some borrowers don't have time to take advantage of new opportunities before rates bounce back up. In other words, this episode of long-term lows is the one that everyone's hearing about AND still has time to take advantage of.

As always, bear in mind that MND's rate index is an average of multiple lenders' daily rate offerings for flawless scenarios. Most loans have some pricing adjustments due to things like loan-to-value (LTV) ratio, occupancy, credit score, etc.

Notably, this week's improvement in rates was accomplished without any obvious source of motivation. There weren't any big ticket economic reports that prompted a reaction in the market. At times, bonds (which dictate rates) seemed to be taking cues from weakness in the stock market, but not with reliable enough correlation to close that case.

Next week could/should be different. The first week of any given month offers several top tier economic reports culminating in the big jobs report on Friday. No other report has more power to cause volatility for rates, for better or worse.