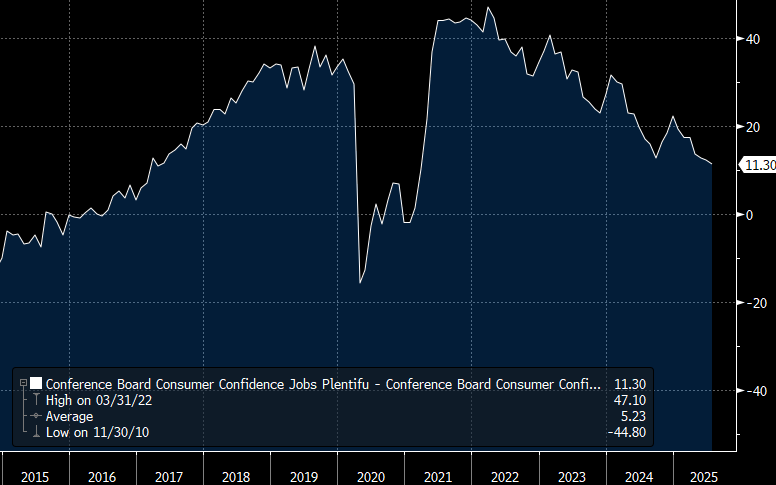

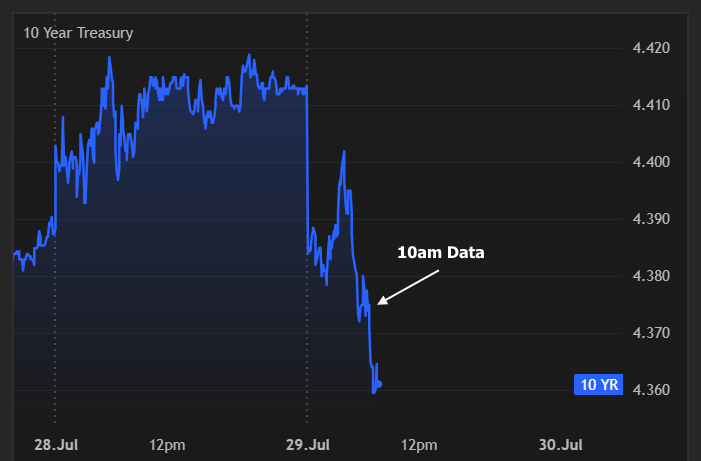

There's no mistaking the fact that bonds are trading in a boring, narrowing, sideways range in the bigger picture, nor could anyone claim that today's trading does anything to change that fact. But for those who will take every little victory they can get, the day is off to a good start. Bonds were initially flat in the overnight session, but began improving a few hours before U.S. trading opened. The 10am econ data was the focus and essentially none of it was unfriendly. Job openings were slightly lower as were job "quits" (fewer people quitting = economically negative and thus a net positive for rates). In a separate labor market indicator inside the Consumer Confidence data, the gap between those who see jobs as plentiful vs scarce fell to another multi-year low. While that so-called "labor differential" is still in 2017 territory (which wasn't a bad year by any means), the trend is friendly for rates.