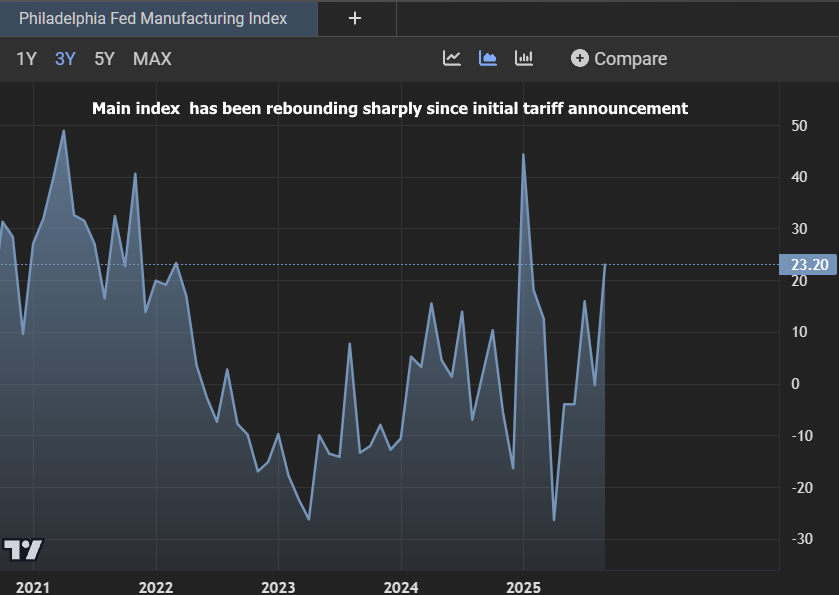

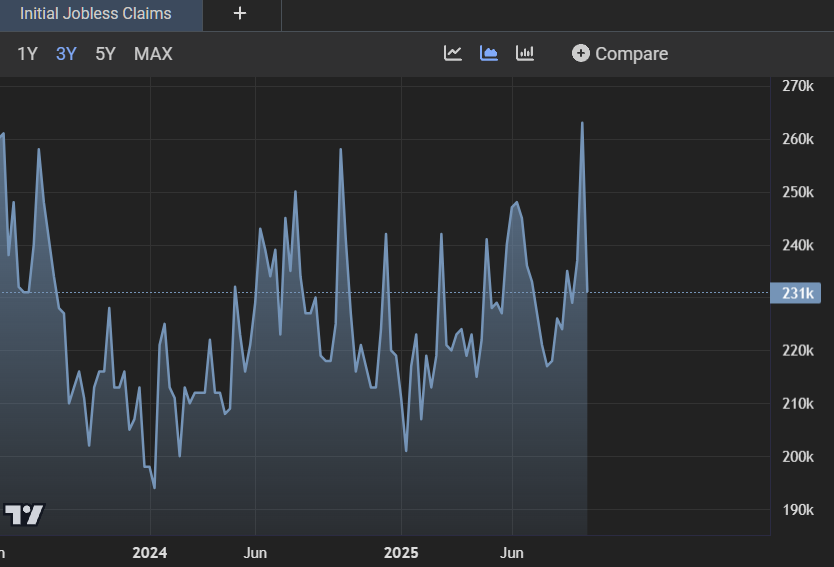

This morning's economic reports (jobless claims and Philly Fed) are not notoriously big market movers, but many analysts gave ample credit to Claims for driving last Thursday morning's rally. Now today, claims are right back in line with the same low levels from 2 weeks ago. Continued Claims are also much lower than expected, including a friendly revision to last week's number. A much stronger Philly Fed result isn't really helping, even if it's probably not hurting as much as the jobless claims reversal. Bonds were slightly stronger before the data, but yields are beginning to lift off since then.

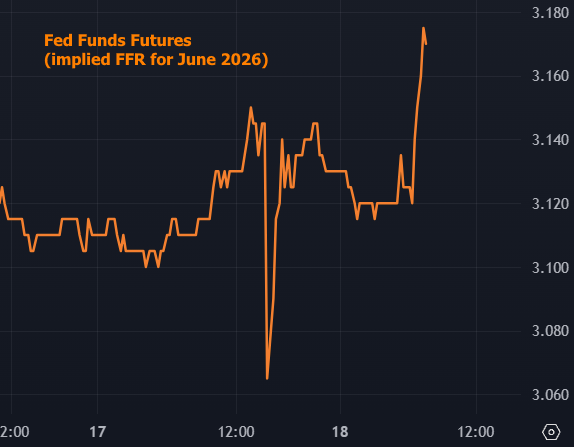

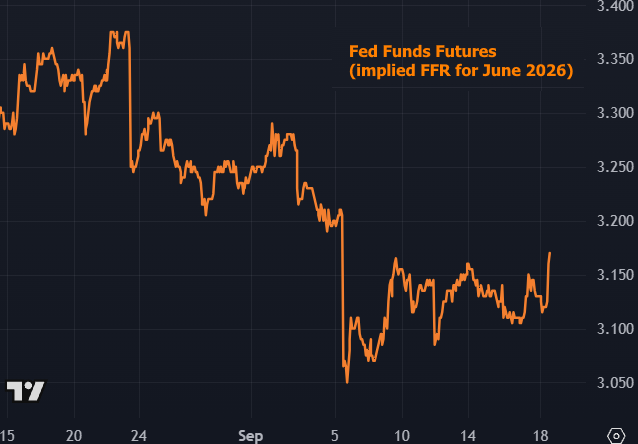

Surprisingly big reaction to this data in Fed Funds Futures (nearly as big as yesterday's Fed announcement).

But not super huge in the bigger picture.

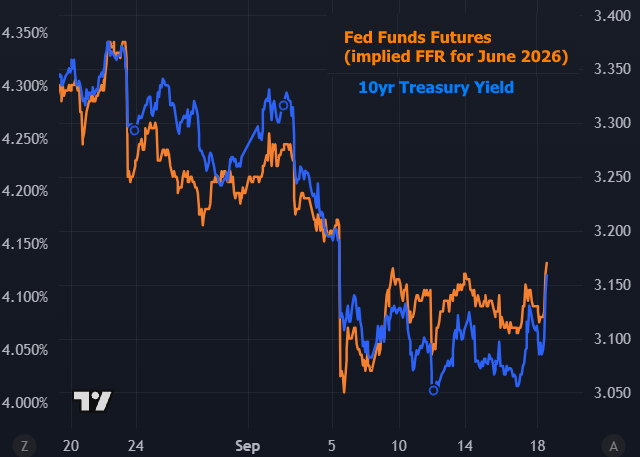

Same chart as above, with 10yr yields on a separate axis.