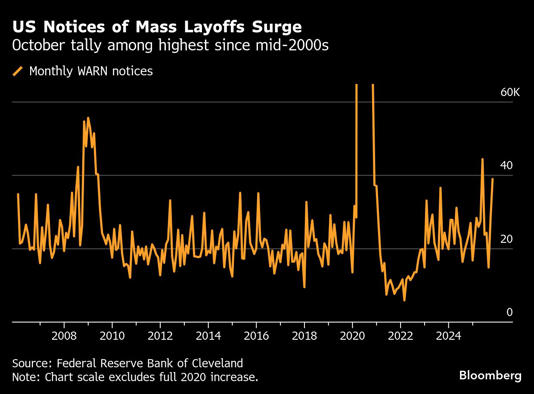

We've seen a clumsy, confused return of various economic reports this morning (several reports were no previously announced with rescheduled release dates). Thankfully, the surprise releases were not big-ticket items. The most relevant report of the morning was ADP's new weekly job count ("NER Pulse") which showed another decline. By the time it came out, bonds had already rallied nicely in the overnight session. This suggests traders were already keen to buy the dip in prices that resulted in yields hitting the top of the recent range. The Cleveland Fed WARN notices (which came out late yesterday) could have helped get the party started.