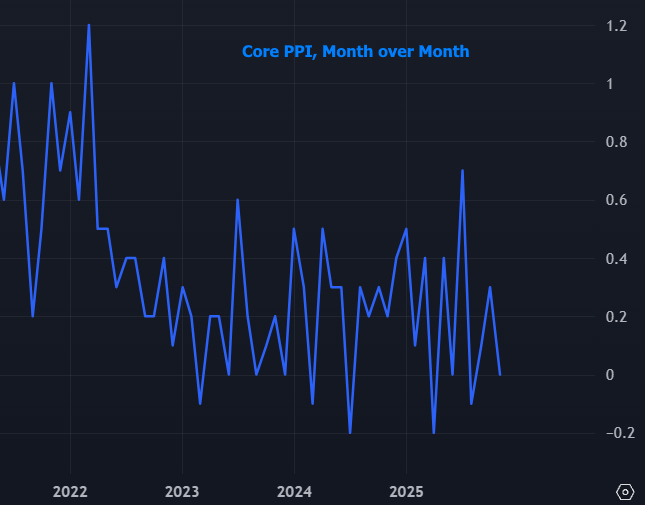

10yr Treasury futures volumes spiked about 5 times higher in the 2 minutes following yesterday's CPI than in the 2 minutes following this morning's PPI/Retail Sales combo. Annual PPI was the highest since July with headline and core both at 3.0%. But November's results were lower than expected (core m/m at 0.0 vs 0.2). It was a big upward revision to September that caused the uptick in the annual number. Retail sales came out a bit stronger at the headline level, but the core was as-expected and the previous month's core was revised down 0.2%. All told, there's no obviously bad news for bonds here and yields are unchanged to slightly lower so far.