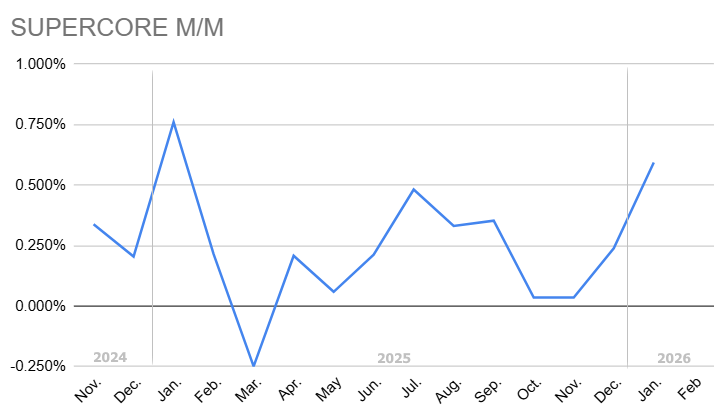

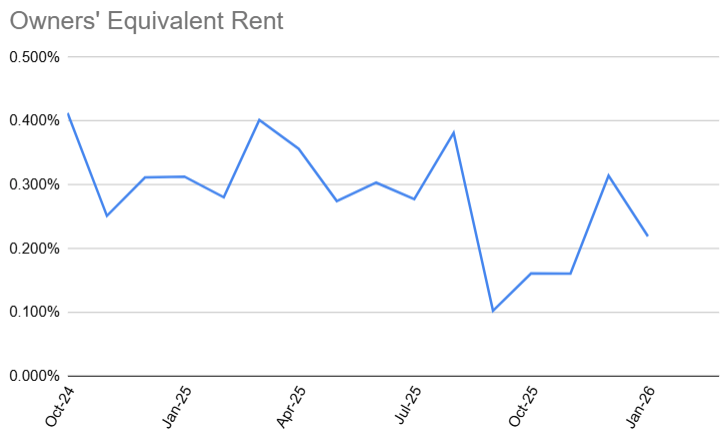

CPI came in just a hair below forecasts at the headline level and right in line with forecasts at the core level (unrounded .295 vs .300). Shelter components continued lower with Owners' Equivalent Rent at 0.220 (basically a cycle low if we ignore the low quality data collection surrounding the government shutdown). The only potential hurdle for the bond market to clear was the surge in the supercore reading to the highest levels in a year. Despite a fair amount of attention paid to supercore in 2025, bonds seem willing to look past this development today, perhaps concluding that it's more important for housing-related metrics to continue their decline. 10yr yields are adding to this week's rally, down about 3bps at 4.07 an hour after the data.