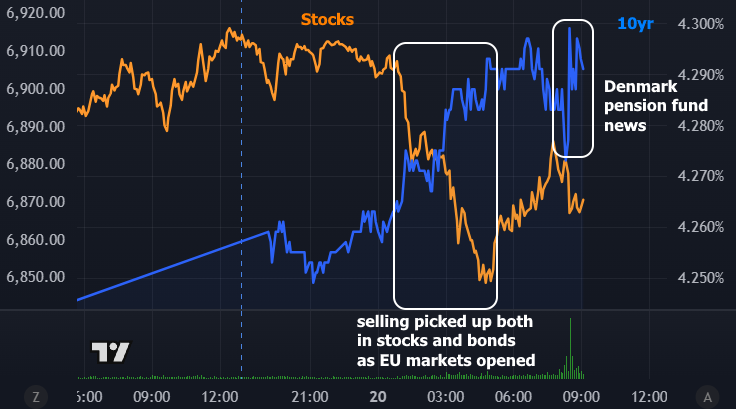

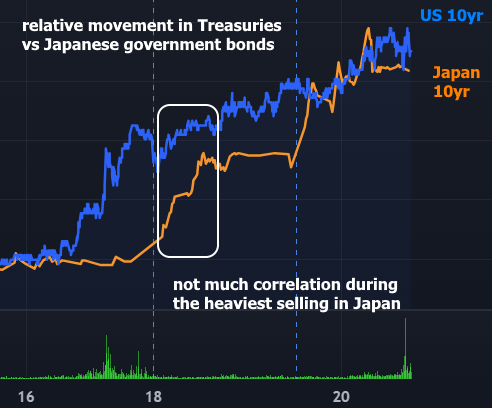

As Trump's Greenland aspirations continue unabated, measurable fallout is increasing. Part of the strategy is increased tariffs. EU is also planning/threatening retaliatory tariffs as well as suspending talks on the US/EU trade deal. The latest measurable manifestation of this morning's fallout is the announcement that a Danish pension fund is liquidating its Treasury holdings. While the dollar amount isn't huge, it speaks to the risk that other EU countries could follow suit. Granted, this could create problems for those EU funds, but rationality doesn't always prevail amid geopolitical brinksmanship. In addition to all of the above, debt drama in Japan is playing a supporting role, causing a massive surge in Japanese yields overnight and a bit of sympathy selling in US Treasuries.