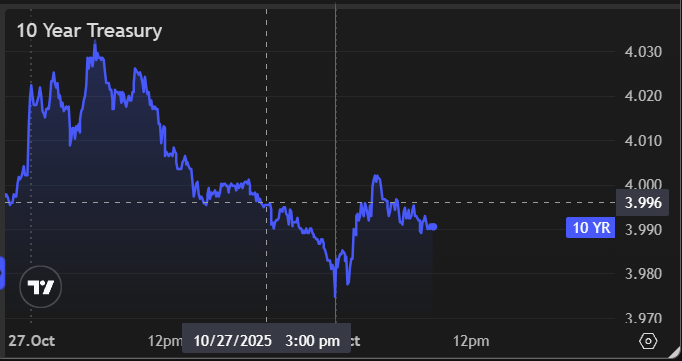

First off, bonds are doing fine this morning. 10yr yields are technically higher on the day, but only when compared to yesterday's 5pm levels. As far as most trade desks are concerned, 3pm is the closing time for Treasuries, and against that benchmark, we're slightly stronger on the morning. MBS are stronger still, almost certainly because they don't have to concern themselves with the digestion of $183bln of new issuance over the first 2 days of the week (unlike Treasuries). With that in mind, keep an eye on today's auction results (typically 1:02pm, despite the 1pm official time). Bonds will either be seeing some post-supply relief, or simply locking into whatever the pre-Fed positioning trade may be.

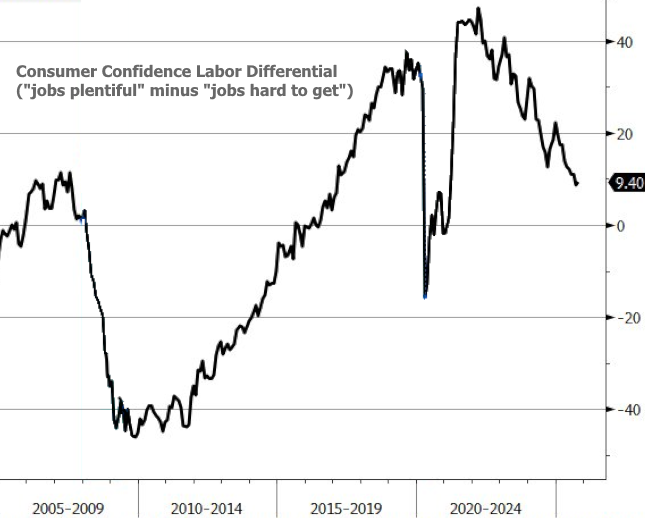

Bonus chart: Labor Differential (a metric inside the consumer confidence numbers that shows the spread between those who view jobs as being plentiful vs those who say jobs are "hard to get"). It's hard to see in the chart, but that 9.40 reading is up slightly from last month.